Fortlaufende Terminkontrakte mit Back-Adjustment

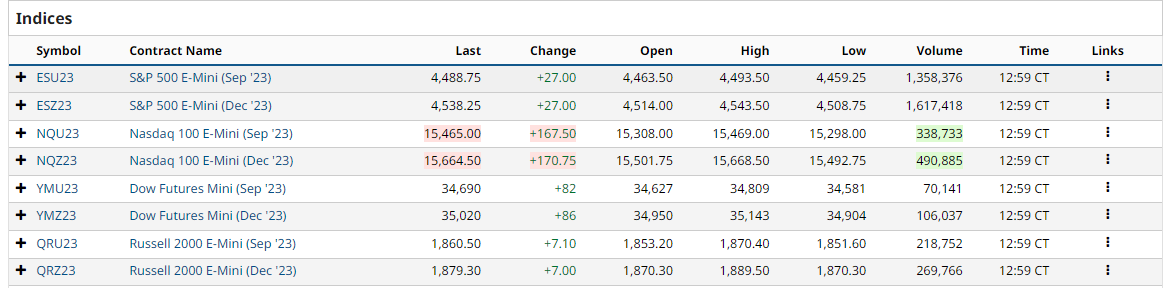

Zurzeit findet der Kontrakt-Roll-Over für US-Indizes-Kontrakte von Sep-23 auf Dez-23 statt. Die Preisdifferenz zwischen den beiden Verfallmonaten ist recht hoch, wie die folgende Tabelle zeigt:

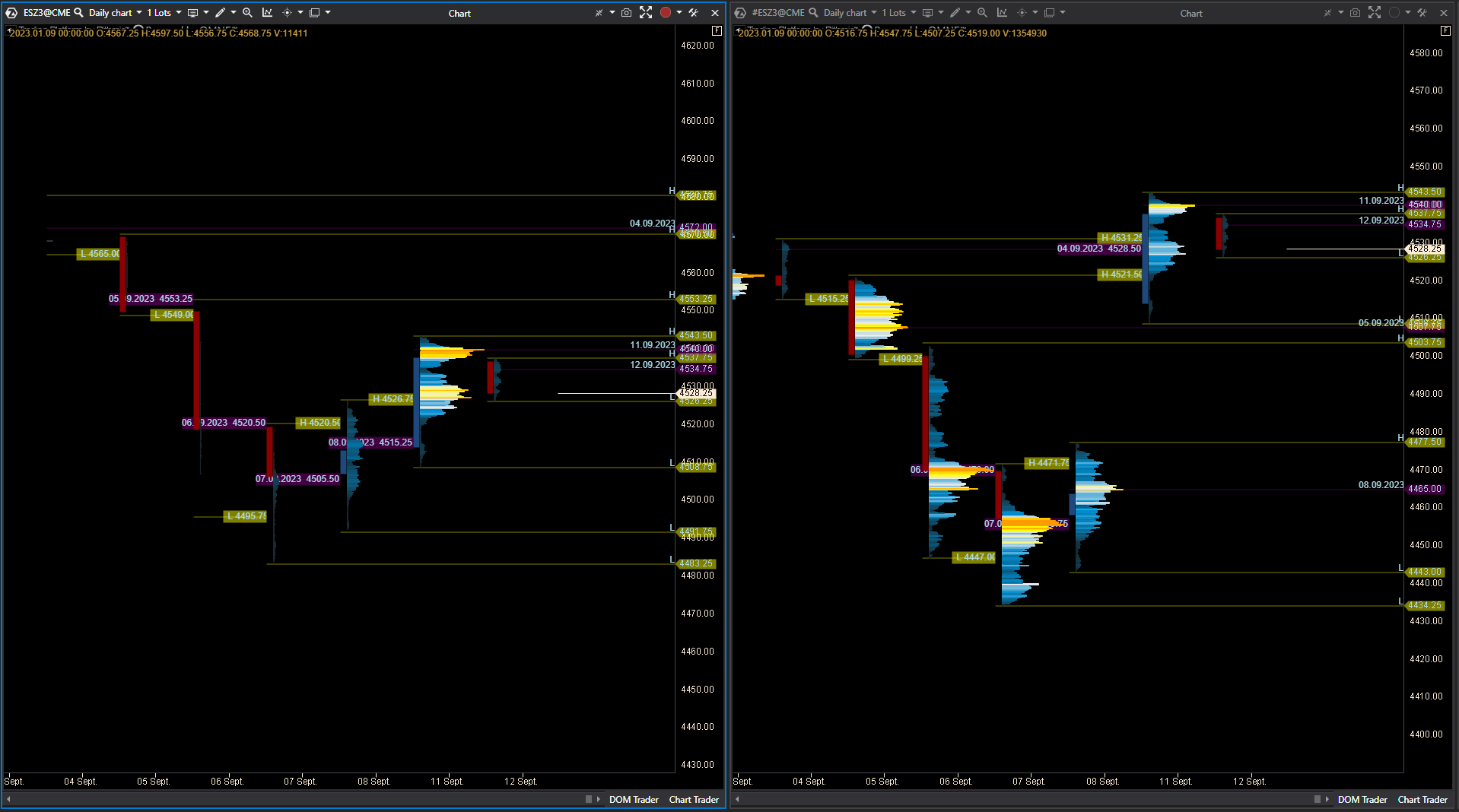

Die bereits vorhandenen fortlaufenden Kontrakte in ATAS (mit Präfix #) verketten diese Kontrakte nach dem ersten Tag höheren Volumens im neuen Kontrakt, d.h. nach Closing des 11/09/2023. Diese unangepasste Verkettung der Kontrakte führt zu einer großen Preislücke, die jegliche Charts der #-Kontrakte verfälscht, d.h. jegliche (Volumen-) oder Pivot-Level-Analyse im #-Kontrakt ist meiner Meinung nach derzeit völlig irreführend.

(links: Z3-Kontrakt, rechts: Kont. Kontrakt)

Vorschlag: Einführung einer zweiten Version von Dauerkontrakten (z.B. mit Präfix +) mit differenzbereinigten historischen Kursen für die Altkontrakte, wie sie in anderen Charting-Plattformen (SierraCharts, MotiveWave, NinjaTrader) zur Verfügung steht.

Die beste Möglichkeit wäre m.E. die Verwendung der Preisdifferenz der Tagesmittelkurse des letzten aktiven Tages des Altkontraktes. In der obigen Tabelle wäre das für ES:

((4543,50+4508,75,25)/2) - (4493,50+4459,25)/2 = 49,75 (ggf. auf den nächsten Tick gerundet).

Das bedeutet, dass alle historischen Daten bis zum EoD 11.09.2023 um 49,75 Punkte erhöht werden sollten, um die Preislücke zum Dezemberkontrakt anzupassen. Dieser Vorgang wäre bei jedem Roll-Over in der Vergangenheit und in der Zukunft notwendig. Ich gehe davon aus, dass es einfacher sein sollte, dies auf den Datenservern von ATAS zu verarbeiten, dies würde jeglichen Programmieraufwand in der Client-Software vermeiden.

Bitte authentifizieren Sie sich, um an der Diskussion teilzunehmen.

Planned

💡 Feature-Anfragen

Vor mehr als 2 Jahren

Joerg

Beitrag abonnieren

Per E-Mail benachrichtigt werden, wenn Änderungen vorliegen.

Planned

💡 Feature-Anfragen

Vor mehr als 2 Jahren

Joerg

Beitrag abonnieren

Per E-Mail benachrichtigt werden, wenn Änderungen vorliegen.