Continous Futures Contracts with Back-Adjustment

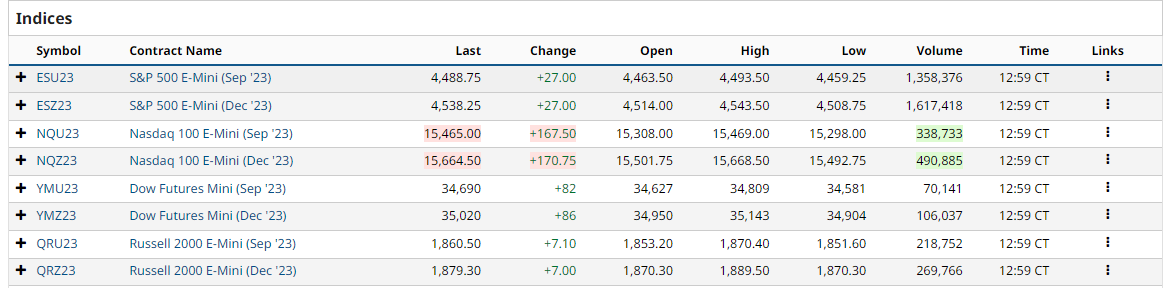

Currently the contract roll-over for US indices contracts from Sep-23 to Dec-23 takes place. The price difference between both expiration months is quite high as shown in the following table:

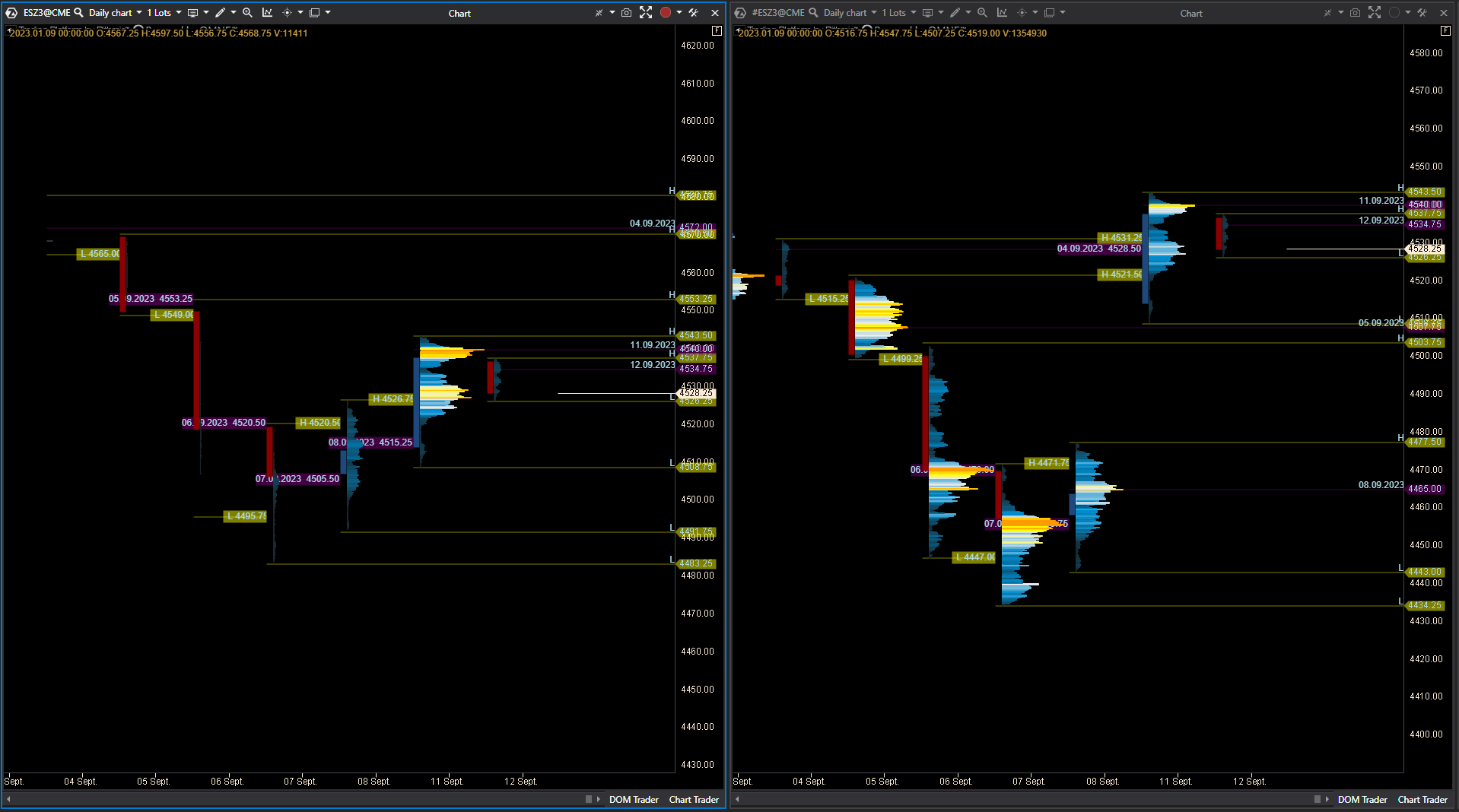

The already available continuous contracts in ATAS (with prefix #) link these contracts after the first day of higher volume in the new contract, i.e. after closing of 11/09/2023. This un-adjusted chaining of contracts leads to a big price gap which corrupts any charts of the #-contracts,I.e. any (Volume-) or Pivot-Level Analysis in #-contract is currently totally misleading in my opinion.

(left: Z3 contract, right: Cont. contract)

Proposal: Introduction of a second version of continuous contracts (e.g. with prefix +) with difference-adjusted historical prices for the old contracts as it is available in other charting platforms (SierraCharts, MotiveWave, NinjaTrader).

The best possibility would be -in my opinion- to use the price difference of the daily mid-prices of the last active day of the old contract. In the table above this would be for ES:

((4543,50+4508,75,25)/2) - (4493,50+4459,25)/2 = 49,75 (rounded to the nearest tick if necessary).

This means all historical data until EoD 11/09/2023 should be increased by 49,75 points in order to adjust the price gap to the December contract. This process would be necessary for each roll-over historically and in the future. I assume it should be easier to process this on the data servers of ATAS, this would avoid any programming work in the client software.

Please authenticate to join the conversation.

Planned

💡 Feature Request

Over 2 years ago

Joerg

Subscribe to post

Get notified by email when there are changes.

Planned

💡 Feature Request

Over 2 years ago

Joerg

Subscribe to post

Get notified by email when there are changes.